The U.S. economy is on a weaker footing.

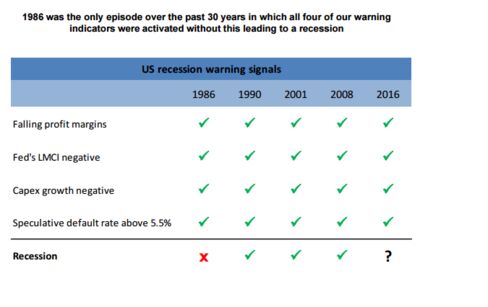

Falling corporate margins, weakness in the U.S. labor market and rising corporate default rates — all features of the U.S. economy in 1986, a year it avoided a recession.

Even if this year markets are largely shrugging off the deterioration in those key indicators and betting grim readings are down to temporary forces, Deutsche Bank AG strategists say to take little hope from a 30-year old precedent.

Investors jittery over bleak readings on a slew of macro and corporate data have seized on 1986, when the same signals for a U.S recession were in place but the economy ended up growing 3.5 percent after inflation.

But bets on the continued expansion in U.S. output over the next year might be misplaced, according to European equity strategists at Deutsche Bank, since the economy is on a significantly weaker footing compared to the year that saw the release of Ferris Bueller's Day Off.

They restate the bank's call that there's a 30 percent probability that the U.S. will succumb to a recession over the next 12 months. That compares pessimistically with the 20 percent that is the average expectations of analysts surveyed by Bloomberg — and even with other analysts at the bank.

Deutsche Bank AG

The strategists led by Sebastian Raedler challenge the view that the U.S. economy can repeat that feat, and brand 1986 a historic outlier.

They cite three factors in Tuesday's report:

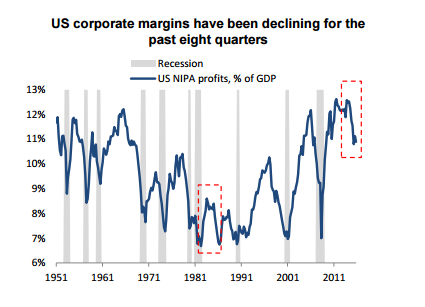

a) 1986 was the only episode over the past 60 years in which U.S. corporate margins declined (from 8.6 percent in the second quarter of 1984 to 6.7 percent in in the fourth quarter of 1986) without this leading to a recession

b) it was the only episode over the past 40 years during which capex growth turned negative (driven by falling energy investments) without this leading to a recession

c) it was the only episode over the past 30 years in which speculative default rates rose meaningfully above 5 percent without this leading to a recession.

Among the signs that all is not well in Corporate America, is the fact that U.S. profit margins have been on a declining path for the past eight quarters from their peak in the second quarter of 2014. The Federal Reserve's Labor Market Condition Index (LMCI), which gives a broad view of the momentum of the jobs market, turned negative in August compared with the year earlier, and in five of the seven occasions that's happened over the past 40 years such a decline has coincided with the onset of a recession.

Deutsche Bank AG

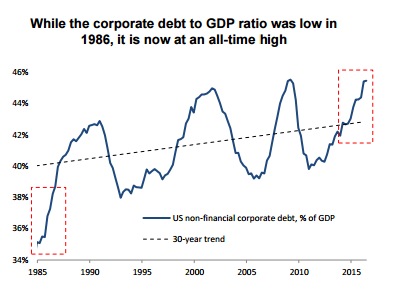

The strategists struggle to see the upside in the U.S. macro cycle, even while the Fed may raise rates this year, citing the likelihood that rising labor costs will depress profit growth, the fact that the U.S.-corporate-debt-to-GDP ratio is at an all-time high, and given that monetary tightening could prompt yet more defaults.

Striking a much more bullish note, Deutsche Bank strategists led by Binky Chadha cited similar factors — a pick-up in income growth, a strong dollar, and the prospect of monetary tightening — as reasons why U.S. productivity might in fact riseover the next year, offering a boon to corporate margins and nominal GDP.

Striking a much more bullish note, Deutsche Bank strategists led by Binky Chadha cited similar factors — a pick-up in income growth, a strong dollar, and the prospect of monetary tightening — as reasons why U.S. productivity might in fact riseover the next year, offering a boon to corporate margins and nominal GDP.

Deutsche Bank AG