by

-

Commodities will help nominal GDP grow 5% next year: Macquarie

-

Government still not incorporating price spike into forecasts

The news out of Australia isn’t all gloom.

While growth figures stank last quarter, the nation is again being cushioned by its status as the developed world’s most China-dependent economy. Surging coal and iron ore prices have helped ease an erosion of national income Down Under and, together with a slower slide in mining investment, signal better prospects ahead.

Australia can thank its No. 1 trading partner, whose old

economy is reviving as fiscal stimulus gets smokestacks billowing

again. Traditional Chinese industries seen as proxies for growth, such

as electricity and rail cargo, have collectively bounced back to the

highest level in three years. The big unknown: the durability of a

turnaround that’s ended a more than 50 percent drop in commodity prices

between 2011 and 2016.

“This story is a big one for Australia,” said Paul Bloxham,

chief Australia economist at HSBC Holdings Plc, who previously worked at

the nation’s central bank. “We’ve talked about the commodity price rise

as being a game-changer.”While growth figures stank last quarter, the nation is again being cushioned by its status as the developed world’s most China-dependent economy. Surging coal and iron ore prices have helped ease an erosion of national income Down Under and, together with a slower slide in mining investment, signal better prospects ahead.

Macquarie Bank Ltd. predicts Australia’s terms of trade -- export prices relative to import prices -- will climb 7 percent next year. That will help lift nominal GDP growth to more than 5 percent, which would be the best result since 2011, said James McIntyre, head of economic research in Sydney.

But this “boom” is different. While a big winner should be government revenue as higher prices boost the profits of mining companies and the taxes they pay, weaker wage growth may cancel out that benefit.

High Hopes?

Aussies probably shouldn’t bet on fatter wallets either. In the previous boom, governments recycled cash back to citizens through tax cuts, higher benefit payments and increased fiscal spending to “turbo-charge” the economy.“That’s not going to happen this time,” said McIntyre. “Any extra revenues will help offset areas of weakness for the budget like underemployment and low wages growth; every additional dollar over that is likely to go into budget repair. Those hoping for a redux of the 2000s boom are likely to be disappointed.”

The Liberal-National coalition government is wary of incorporating higher coal and iron ore prices into its forecasts after its Labor party predecessors were burned by excessive optimism. With Australia battling to maintain its AAA credit rating and Treasurer Scott Morrison aiming to return to a balanced budget by fiscal year 2021, it could be tempting.

“We’re not forecasting it in,” Trade Minister Steven Ciobo said in an interview Thursday in Jakarta. “Treasury has made not a forecast but an assumption with respect to commodity prices. Obviously, the stronger commodity prices are, the better that that is for Australia. We’ve never pretended otherwise.”

Data out Thursday showed the deficit subsequently widened to A$1.5 billion in October, compared with economists’ forecasts for a A$610 million gap. Deutsche Bank AG analysts suggested a lag between spot and contract prices for commodities; on top of that, almost A$500 million of capital goods were imported in the month.

The deficit is still expected to narrow as the data more fully reflects coal’s surge. So Ciobo may yet oversee a trade surplus, a rarity for any minister that’s held the post.

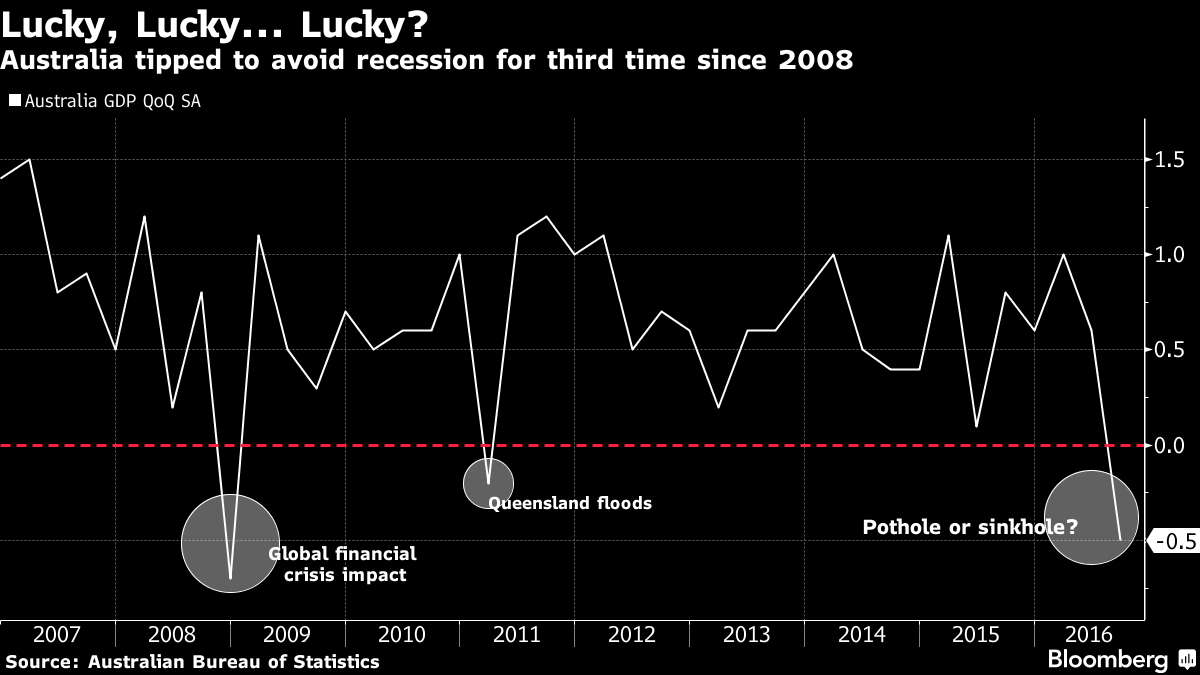

That would prove welcome news for the government after data Wednesday showed the economy shrank in the three months through September by 0.5 percent, only the fourth quarterly contraction in the past 25 years. Economists surveyed by Bloomberg forecast an expansion this quarter of 0.6 percent.

Even if China eases stimulus, its decision to shutter excess capacity in the coal industry may continue to aid Australia, while U.S. President-elect Donald Trump’s infrastructure investment push could also provide additional support to commodities.

Exports “are a key driver of the growth story in Australia and in many respects the GDP number just reinforces the value that exports will have,” said Ciobo. “But look, it’s a volatile time. And so export growth is going to continue to be a key driver for our economy for some time.”