Citigroup Inc. joined Goldman Sachs Group Inc. in backing

commodities, saying it’s the season to have faith in raw materials and

oil will probably rally to the mid-$60s by the end of the year.

While

U.S. shale output may come “roaring back” amid higher crude prices,

production curbs by OPEC and its allies should help offset that increase

over the next six to nine months, Citi analysts including Ed Morse and

Seth Kleinman wrote in an April 17 report. The producers need to extend

their deal to cut supplies through the end of the year amid concerns

that Russia is lagging behind on its pledged reductions, the bank said.

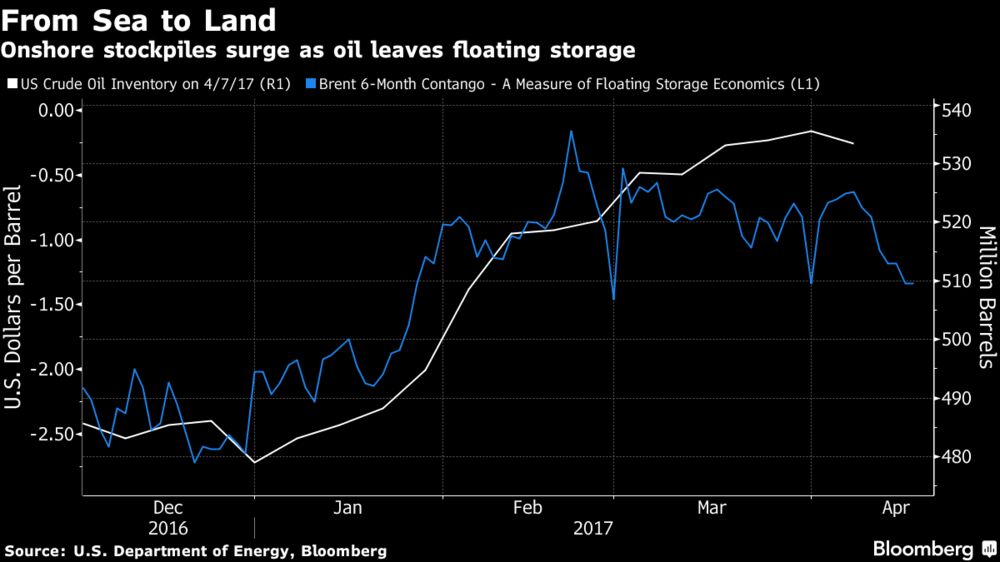

While the historic agreement between producers that

went into effect Jan. 1 “induced a euphoric and unsustainable surge” in

bullish bets by investors, that also set the stage for an inevitable

sell-off as record fourth-quarter OPEC output and oil stored at sea

moved to onshore sites, according to Citigroup. Goldman Sachs has also

made similar comments, saying ample inventories that have undermined the

output cuts are set to shrink and calling for more

patience from the market.

“With a continuation of the OPEC and non-OPEC producer deal

in the second half of 2017 and the expected associated inventory

draw-down, we expect oil prices to move above $60 a barrel by the second

half of the year,” the analysts wrote in the note. Still, increased

supplies from producers in the fourth quarter of 2016 is now “a dark

cloud hanging over the market,” and a failure to extend the output

agreement would send prices “precipitously lower,” they said.

The

bank expects U.S. West Texas Intermediate oil to average $62 a barrel

and global benchmark Brent crude to average $65 a barrel in the fourth

quarter. WTI was trading 30 cents lower at $52.35 a barrel on the New

York Mercantile Exchange at 10:34 a.m. London time on Tuesday. Brent on

the ICE Futures Europe exchange was down 35 cents at $55.01 a barrel.

Supply Surge

The production-cut agreement

spurred

a change in market structure that meant traders had less incentive to

store oil at sea, prompting the flow of supplies floating on ships to

onshore sites. That set the stage for boosting U.S. inventories to a

record in the first quarter of 2017, the bank said.

This gain and a

surge in output by the Organization of Petroleum Exporting Countries in

the fourth quarter had an effect that would “ultimately obstruct and

for a period of time reverse the very rebalancing they were trying to

accelerate,” the analysts said. The bank expects U.S. liquids output to

grow year-over-year at 1 million barrels per day or more by December.

The

drop in oil prices during March led declines across commodities,

according to Citigroup. It estimates commodity assets under management

grew about $45 billion in the first two months of the year but gave up

$35 billion during the selloff in raw materials in March. Investment

inflows should increase in the second quarter, the bank predicted.

“Do commodities need a bit of a prayer to rebound in ‘17?

Probably not,” the analysts wrote. “Commodities stumbled through the

first quarter following what was clearly the healthiest year for the

sector since the decade began. In retrospect part of the sell-off toward

the end of the last quarter was too much froth in critical subsectors

like oil, copper and iron ore. But signs of better performance are

increasingly clear, despite major risks.”