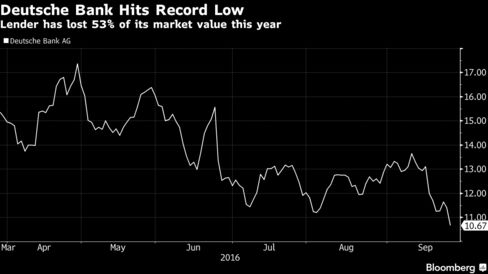

Stocks almost erased their monthly advance as Deutsche Bank AG sank on speculation it will need to raise capital. Bonds climbed as traders awaited a U.S. presidential debate tonight.

Financial companies dragged down global equities after a media report said the German government wouldn’t step in to back the nation’s largest lender, fueling investor concern about its finances. Treasury yields declined to a two-week low, and the yen led gains among its Group-of-10 peers as investors sought safer assets. Emerging-market shares slumped after Turkey’s credit rating was cut to junk by Moody’s Investors Service. Oil surged as Saudi Arabia’s offer to cut output opened the door to a future OPEC deal.

All the anxiety over capital buffers put European banks in the spotlight at a time when the region’s economy has been sending mixed signals. While a spokesman for Chancellor Angela Merkel told reporters there are “no grounds” for speculation over state funding for Deutsche Bank, the International Monetary Fund said in June that the lender may be the biggest contributor to systemic risk among the world’s largest financial companies. Meanwhile, traders awaited the first of three U.S. presidential debates ahead of the Nov. 8 election and a meeting between major oil producers this week.

“The negative implications of what’s happening at Deutsche Bank are weighing on sentiment,” said Michael James, managing director of equity trading at Wedbush Securities Inc. in Los Angeles. “The spillover from Friday’s weak action, with nothing material coming from overseas other than the Deutsche Bank concerns, it’s not surprising to see the market with a weaker tone. There isn’t a lot happening this week, so the presidential debate is likely to have a big impact tomorrow and potentially going forward.”

Donald Trump and Hillary Clinton are locked in a tied two-way race for the presidency as they head to Hofstra University in New York on Monday night for one of the most highly anticipated debates in modern politics. The Republican and Democratic nominees each get 46 percent of likely voters in a head-to-head contest in the latest Bloomberg Politics national poll, while Trump gets 43 percent to Clinton’s 41 percent when third-party candidates are included. A Trump victory could lead to equity declines, Citigroup Inc. analysts warned last month.

Investors are also turning their attention to economic data and the prospects for corporate profits, with Alcoa Inc. unofficially kicking off the next earnings season when it reports results on Oct. 10. Purchases of new U.S. homes dropped in August after surging a month earlier to the fastest pace since 2007, figures from the Commerce Department showed Monday in Washington.

Stocks

The MSCI All-Country World Index fell 0.8 percent as of 11:41 a.m. in New York, declining for a second day. The Stoxx Europe 600 Index dropped 1.6 percent, its biggest slide since early July, while the S&P 500 Index slipped 0.7 percent to 2,149.69.

JPMorgan Chase & Co. and Wells Fargo & Co. led losses in American financial companies, while Deutsche Bank shares sank 7.5 percent amid concerns that mounting legal bills may force the German lender to raise capital. Bats Global Markets Inc. tumbled after agreeing to be bought by CBOE Holdings Inc. for about $3.2 billion in cash and stock. Bats jumped 20 percent Friday on a Bloomberg report that the two companies were in talks.

The S&P 500 on Friday capped its biggest weekly advance in more than two months as investor concern eased about central banks’ willingness to stimulate growth. The Federal Reserve last Wednesday held off raising rates, helping the equity benchmark recover from a rout earlier in September and return as of Friday’s close to within 1.2 percent of a record set in mid-August.

A measure of emerging-market stocks slumped 1.3 percent as Turkish shares led losses among the world’s biggest equity markets.

Bonds

Yields on 10-year Treasuries fell three basis points, or 0.03 percentage point, to 1.59 percent, according to Bloomberg Bond Trader data.

“U.S. politics are moving right to center stage,” said Rene Albrecht, a rates and derivatives analyst at DZ Bank AG in Frankfurt. “There are rising uncertainties about the effects of the election results. And when you got uncertainty, you better rotate out of stocks and into safe havens.”

German 10-year bund yields fell three basis points, or 0.03 percentage point, to minus 0.11 percent, extending a drop of nine basis points from last week. The yield on Italian 10-year bonds retreated three basis points to 1.19 percent, while the yield for similar maturity Spanish debt slid five basis points to 0.92 percent.

Mario Draghi said euro-area governments must act to stem rising public discontent, in his latest warning to politicians that the European Central Bank can’t sustain the region’s recovery alone. The central bank’s program to buy 80 billion euros ($90 billion) a month of debt faces scarcity concerns and its negative interest rates have prompted criticism by banks and savers.

“Low rates are a symptom of the underlying economic situation,” Draghi said. “Other policy actors need to do their part, pursuing fiscal and structural policies which will contribute to a self-sustaining recovery and increase the economic growth potential of the euro area.”

Currencies

Bloomberg’s Dollar Spot Index, which measures the greenback against major peers, fell 0.3 percent. The yen rose against all but one of its major peers. The pound was little changed after more than three-quarters of chief executive officers in a KPMG surveysaid they’d consider moving operations outside the U.K. following the vote to leave the European Union.

“Foreign-exchange markets are getting off to a cautious start this week,” said Ned Rumpeltin, European head of currency strategy at Toronto-Dominion Bank in London. “Banks and Brexit newsflow keep European risks in the frame, while the U.S. presidential debate tonight is a key focus for investors.”

The Philippine peso sank to a seven-year low as investors pulled money from the nation’s assets amid concerns over the fallout of President Rodrigo Duterte’s anti-drug war and his outbursts against the U.S. and the United Nations

Commodities

"I think it’s positive that OPEC is getting together," Francisco Blanch, head of commodity markets strategy at Bank of America Merrill Lynch in New York, said in a Bloomberg television interview. "It’s in the Saudi’s interest and other OPEC member’s interest to start coming together and do something."

West Texas Intermediate for November delivery rose 3.7 percent to $46.13 a barrel on the New York Mercantile Exchange. The contract lost $1.84 on Friday, the biggest decline since July 13.

Gold may be in for a bumpy ride in the final quarter as U.S. Republican candidateTrump now has a 40 percent chance of winning the presidential election and investors will be preparing for the possibility of higher interest rates, according to Citigroup.

“Polls have started to tighten ahead of the U.S. presidential election, and Citi has raised the probability of a Trump victory,” the bank said in the note. “We expect a Trump win would bring out higher volatility in gold and forex, which in turn should lead to higher volumes in other precious metals.”