By and

- Uneven rebound leaves Connecticut, Nevada, others behind

- GDP, employment, home prices are taking longer to recover

As the U.S. economy enters its ninth year of expansion this month, many Americans feel the recovery has been incomplete -- and the numbers back them up.

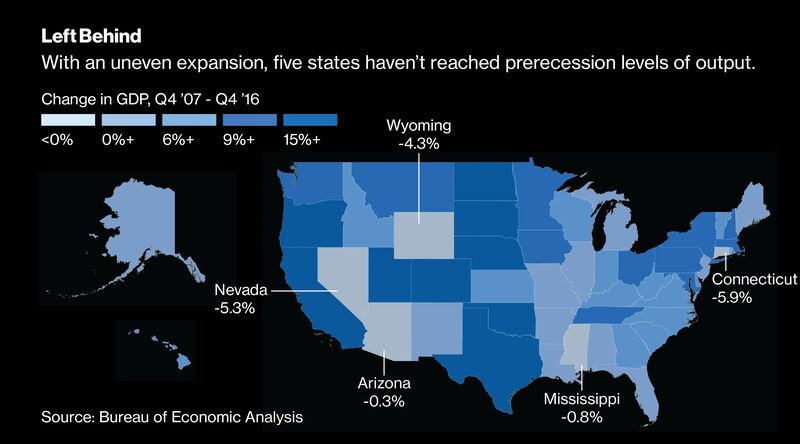

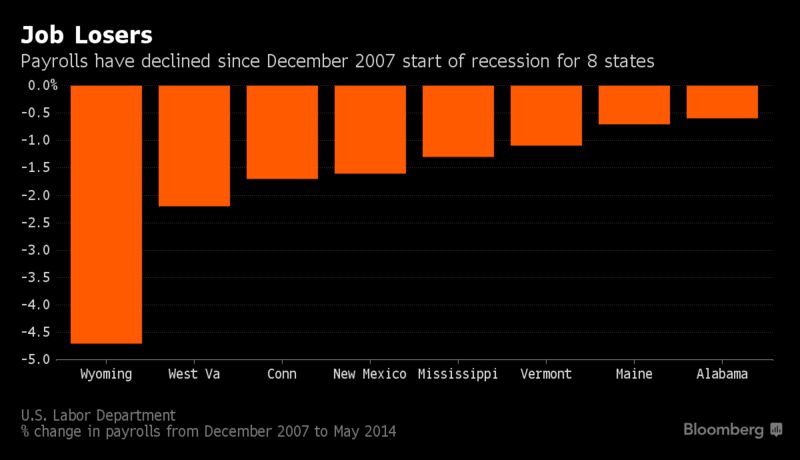

Five states -- Arizona, Connecticut, Mississippi, Nevada and Wyoming -- still haven’t regained their levels of gross domestic product from before the financial crisis, more than five years after the country as a whole hit that milestone. Eight states are below prerecession levels of employment. And 15 have home prices that have yet to rebound fully.

While each of the states has individual obstacles, they illustrate how growth has lagged outside of the nation’s largest cities in New York, California and Florida. And though President Donald Trump won some of the states last November after highlighting sectors and regions that have lagged for years -- including, for example, coal mining in West Virginia and manufacturing jobs in the Midwest -- the pain hasn’t been limited to Republican territory.

“The hallmark of the recovery is that it is being driven by the nation’s largest metro areas,” said Mark Zandi, chief economist at Moody’s Analytics in West Chester, Pennsylvania. “Metro areas have attracted millennials and boomer empty-nesters and are globally oriented, benefiting from global capital inflows. Rural economies that are dependent on commodity-based activities have suffered.”

Wyoming’s Dependence

Wyoming -- which has the second-smallest economy and depends on mining for one-fourth of GDP -- is a prime example, having suffered the biggest percentage decline in payrolls from the start of the recession in December 2007. The state, which went for Trump, is likely to be among the final two to return to peak employment, in 2022, according to forecasts by IHS Markit economists.

The state’s tourism business, including the Jackson Hole resort and park area, was also slow to recover in the wake of consumers’ household wealth dropping, said Anne Alexander, a University of Wyoming economist. While tourism has since bounced back, the state’s huge energy sector has slumped since 2014.

“There’s been a significant slowdown in the past couple of years,” she said. “Natural gas prices fell first, then oil, and then coal production took a dive.”

The recent energy downturn has taken a toll on a number of states. Moody’s Analytics considers Alaska and West Virginia -- both big producing states -- now the only two in recession. Even so, energy states have been leaders in increasing production and employment since 2007, including North Dakota, South Dakota and Texas, which benefited from earlier booms in prices as well as new lower-cost production techniques.

Nevada Bust

Nevada has also had a tough road back, having failed to reach prerecession levels of GDP and home prices. It was among a handful of states, also including Florida, Georgia, California and Arizona, where the 2006 housing bust was particularly severe. Las Vegas hotels, restaurants and casinos suffered when consumers bolstered savings in the wake of the 2007-2009 downturn.

In northwestern Nevada, business at 600-employee Q&D Construction Inc. is growing again but hasn’t returned to 2006 levels when it employed 1,100 people. The company builds roads, hospitals, schools and airport facilities as well as housing.

“Things are coming back,” but Nevada “has not gotten back to where it once was,” said Lance Semenko, Sparks-based Q&D’s chief operating officer.

The 4.7 percent unemployment rate in Nevada, though below the 5.1 percent level when the recession began, remains above the housing-boom figure of 3.9 percent last seen in early 2006. Nevada, which voted for Clinton, had the highest percentage of homes with mortgages in excess of the value of homes, or negative equity, at 12.4 percent, followed by Florida, Illinois, New Jersey and Connecticut, according to real estate researcher CoreLogic Inc.

“Our recession was longer and deeper so naturally it will take us longer to recover,” said Stephen M. Miller, director for the Center for Business and Economic Research at the University of Nevada at Las Vegas.

The regional disparities aren’t holding back Federal Reserve policy makers from raising their benchmark interest rate and eyeing a reduction in their $4.5 trillion balance sheet. Central bankers, though mindful of the uneven circumstances, look at the country as a whole when making decisions and generally consider the 4.3 percent U.S. unemployment rate to be below the level consistent with full employment.

Recovery ‘Complete’

“The national recovery is absolutely complete,” said Stanford University economist Robert Hall, who heads the National Bureau of Economic Research committee that dates recessions.

Other issues plaguing the laggard states include slow growth in federal spending in New Mexico and below-average education levels in Mississippi and Alabama, economists said.

Connecticut is another story. In the New England state, which went for Clinton, General Electric Co. last year announced it was moving its headquarters to Boston, followed by Aetna Inc. deciding in June to relocate to New York City. Connecticut’s bonds were downgraded in May after the state faced a widening deficit. Florida Governor Rick Scott even visited the state in June to try to persuade companies to move south.

“Taxes and spending that can’t be sustained” are hurting the economy, said Don Klepper-Smith, chief economist at consulting firm DataCore Partners LLC in Durham, Connecticut. “Lack of fiscal discipline is creating an air of uncertainty. There is a loss of confidence in the business community.”

“We are underperforming in a rather dramatic fashion,” he said.