- Chemical earnings rise 38 percent as drilling posts a loss

- Profit of $1.8 billion is lowest in more than decade

First-quarter net income fell to $1.81 billion, or 43 cents a share, from $4.94 billion, or $1.17, a year earlier, Exxon said in a statement on Friday. The quarterly profit was the lowest since March of 1999, before Exxon merged with Mobil Corp. Still, the per-share result was 15 cents above the 28-cent average of 19 analyst estimates tracked by Bloomberg.

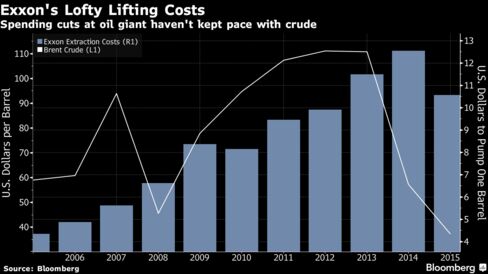

The company was boosted by a 38 percent increase in its petrochemicals division, to $1.4 billion, as well as a 33 percent cut in capital expenditures as it pulled back on drilling and exploration amid weak commodity prices. The world’s biggest non-state oil explorer joined energy giants BP Plc, Statoil ASA and Total SA this week in beating analyst expectations on the back of massive cost cuts and strong refining and chemical results even as oil profits vanished.

“I look at this and say is this an oil company?" Pavel Molchanov, a Raymond James Financial Inc. analyst, said of Exxon’s results. “All of its earnings came from refining and chemicals. It did not make any money, for the first time in modern history, on exploration and production."

The quarter showed the strength of Exxon’s diversification, a factor that would limit the company’s appeal to investors as oil prices recover, Molchanov said.

“This company is very refining- and chemicals-centric and those sectors do not benefit from an oil price recovery," he said in a telephone interview.

Rating Cut

Standard & Poor’s on Tuesday stripped Exxon of its the AAA credit rating the company had held since the Great Depression, citing a swelling debt level. The company was cut to AA+, the same as the U.S. government.The chemicals division benefited from stronger margins and higher sales volumes, as the price of raw materials -- oil and gas -- plunged compared to last year’s first quarter. The downstream segment earned $906 million as global gasoline demand remained strong, according to the statement.

“It’s the value of the integrated model," Roger Read, a Wells Fargo Securities LLC analyst in Houston, said in a phone interview. “You buy Exxon for its ability to take advantage in all sorts of commodity environments."

Quarterly Payout

Exxon rose 1 percent to $88.91 at 9:32 a.m. in New York. Shares are up 14 percent this year. Among analysts who follow the company, Exxon has eight buy rating, 13 holds and six sells.The 2016 capital budget has been cut by about 33 percent from last year, a bigger decline than earlier estimated. Despite those measures, full-year profit is expected to dip below $10 billion in 2016 for the first time since the company’s historic acquisition of Mobil Corp. in 1999.

Despite the rout in crude markets, Exxon earlier this week raised its quarterly payout to stockholders by almost 3 percent to 75 cents a share. The pledge will cost the company $3.1 billion when the dividend is paid in June.

“The organization continues to respond effectively to challenging industry conditions, capturing enhancements to operational performance and creating margin uplift despite low prices,” Rex W. Tillerson, chairman and chief executive officer said in the statement. “The scale and integrated nature of our cash flow provide competitive advantage and support consistent strategy execution.”