- Billions of new bills in circulation and still more are needed

- Rampant inflation means gym bags full of cash for dinner

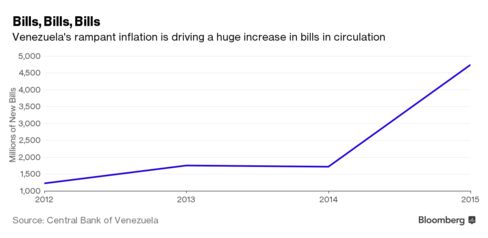

In a tale that highlights the chaos of unbridled inflation, Venezuela is scrambling to print new bills fast enough to keep up with the torrid pace of price increases. Most of the cash, like nearly everything else in the oil-exporting country, is imported. And with hard currency reserves sinking to critically low levels, the central bank is doling out payments so slowly to foreign providers that they are foregoing further business.

Venezuela, in other words, is now so broke that it may not have enough money to pay for its money.

This article is based on interviews with a dozen industry executives, diplomats and former officials as well as internal company and central bank documents. All of the companies declined official comment; the central bank did not respond to numerous requests for interviews and comment.

Thronging Banks

The story began last year when the government of President Nicolas Maduro tried to tamp down a growing currency shortfall. Multi-million-dollar orders were placed with a slew of currency makers ahead of December elections and holidays, when Venezuelans throng banks to cash their bonuses.At one point, instead of a public bidding process, the central bank called an emergency meeting and asked companies to produce as many bills as possible. The companies complied, only to find payments not fully forthcoming.

“It’s an unprecedented case in history that a country with such high inflation cannot get new bills,” said Jose Guerra, an opposition law maker and former director of economic research at the central bank. Late last year, the central bank ordered more than 10 billion bank notes, surpassing the 7.6 billion the U.S. Federal Reserve requested this year for an economy many times the size of Venezuela’s.

World’s Highest Inflation

The currency crisis sheds light on the magnitude of the country’s financial woes and its limited ability to remedy them as oil -- the mainstay of its economy -- continues to flatline. Venezuela’s inflation, the world’s highest, is expected to rise this year to close to 500 percent, according to the International Monetary Fund.The first signs of the currency shortage date back to 2014 when the government began increasing shipments of bank notes as wallet-busting wads of cash were already needed for simple transactions. Venezuelans spend hours waiting in line for consumer staples, lining up first at banks and cash machines, often carrying the loot in backpacks and gym bags to pay for dinner out.

Ahead of the 2015 congressional elections, the central bank tapped the U.K.’s De La Rue, France’s Oberthur Fiduciaire and Germany’s Giesecke & Devrient to bring in some 2.6 billion notes, according to bank documents and people familiar with the deals. Before the delivery was completed, the bank approached the companies directly for more.

De La Rue took the lion’s share of the 3-billion-note order and enlisted the Ottawa-based Canadian Bank Note Company to ensure it could meet a tight end-of-year deadline.

Sniper Cover

The cash arrived in dozens of 747 jets and chartered planes. Under cover of security forces and snipers, it was transferred to armored caravans where it was spirited to the central bank in dead of night.While the cash was still arriving -- at times, multiple planeloads a day -- authorities set their sights on the year ahead. In late 2015, the central bank more than tripled its original order, offering tenders for some 10.2 billion bank notes, according to industry sources.

But currency companies were worried. According to company documents, De La Rue began experiencing delays in payment as early as June. Similarly, the bank was slow to pay Giesecke & Devrient and Oberthur Fiduciaire. So when the tender was offered, the government only received about 3.3 billion in bids, bank documents show.

“Initially, your eyes grow as big as dish plates," said one person familiar with matter. “An order big enough to fill your factory for a year, but do you want to completely expose yourself to a country as risky as Venezuela?”

Further complicating matters is the sheer amount of bills needed for basic transactions. Venezuela’s largest bill, the 100-bolivar note, today barely pays for a loose cigarette at a street kiosk.

Uncharted Territory

As early as 2013, the central bank commissioned studies for 200 and 500 bolivar notes, former monetary officials say. Despite repeated assurances, no new denominations have been ordered, pushing Venezuela into uncharted territory by its refusal to produce larger bills while not fully paying providers.Companies are backing away. With its traditional partners now unenthusiastic about taking on new business, the central bank is in negotiations with others, including Russia’s Goznack, and has a contract with Boston-based Crane Currency, according to documents and industry sources.

Steve Hanke, a professor of applied economics at Johns Hopkins University, who has studied hyperinflation for decades, says that to maintain faith in the currency when prices spiral, governments often add zeros to bank notes rather than flood the market.

“It’s a very bad sign to see people running around with wheelbarrows full of money to buy a hot dog,” he said. “Even the cash economy starts breaking down."