This week Trump released his

latest budget for 2019-20 fiscal year. It calls for $2.7 trillion in

various social spending cuts over the decade, including $872 billion in

reductions in Medicare, Social Security, Disability spending; another

$327 billion in food stamps, housing support, and Medicaid; a further

$200 billion in student loan cuts; and hundreds of billions more in cuts

to education, government workers’ pensions, and funds to operate the

EPA and other government agencies.

Not surprising, the $2.7 trillion in

social program spending cuts will finance spending for the military and

defense related programs like Homeland Security, Border walls, veterans,

police, and programs like school vouchers.

Of course, the budget proposal is

‘dead on arrival’ with the US House of Representatives, which must

approve all spending bills, according to the US Constitution. But don’t

hold your breath. Trump may now have a back door to this Constitutional

obstacle and eventually get his way on the budget, at least in part, to

fund his military spending plans.

Trump’s National Emergency ‘Workaround’ & the Budget

It should not be forgotten, Trump just

enacted his ‘national emergency ’ to build his Mexico border wall by

diverting funds, without Congressional approval, from other sources in

the US budget—i.e. a clear violation of the US Constitution. That

‘national emergency declaration’ will almost surely be approved by his

current stacked US Supreme Court before the end of Trump’s first term.

When approved, the precedent will allow Trump to repeat the action,

perhaps on an even larger scale. So what’s to stop him from using the

same national emergency precedent to shift other funds in the future

from social programs to the military and defense, as he clearly proposes

in this latest budget?

Some liberals and Democrats may

declare he can never do that. But they said the same about his national

emergency declaration to fund his wall, and he declared it anyway. He

will continue to subvert and destroy long-standing rules and even

Constitutional norms within the government. The national emergency

declaration about funding his wall gave him his foot in the door. Will

the Supreme Court eventually allow him to kick it open now in the

future? One shouldn’t be too surprised with this President, who has

little concern or respect for Democratic rights and institutions.

We now have a precedent in the

national emergency declaration. So what’s to stop him from shifting even

more funds from social programs to war, defense and the military? In

other words, to spend a good part of his proposed additional $2.7

trillion for the Pentagon, and to simply divert the funds from Medicare,

Social Security, Education, etc.? The Democrat Party majority’s control

of the US House of Representatives’ may refuse to pass legislation to

approve Trump’s $2.7 trillion budget shift to the military and defense.

But the precedent now exists allowing him to do it. Trump is intent on

getting what he wants, to pander to his right wing base, and get himself

re-elected. He cares little for Democratic norms or civil liberties.

Don’t underestimate his willingness to shred those liberties and subvert

those norms.

As worrisome as the politics of the US

budget process going forward may yet prove to be, however, the

economics of Trump’s 2019-20 budget are more serious. It represents a

trend that will continue whether or not the budget is passed, either in

the short or the longer term by national emergency declaration.

The $34 Trillion National Debt

Whether Trump’s budget is passed or

not, his fiscal policy (taxation and spending) already represents a

faster escalation of US deficits and therefore Debt.

During Trump’s first two years in

office, US federal government deficits have driven the national debt up

already by $3 trillion: At the end of 2016, when Trump entered office,

the US national debt was $19.5 trillion. Today it is $22.5 trillion.

He’s thus already added $3 trillion, a faster rate per year of debt

accumulation than under even his predecessors, George Bush and Barack

Obama.

The Treasury Advisory Committee, a

long standing committee of private experts who regularly provide advice

to the US Treasury, recently warned the US Treasury that it will have to

sell $12 trillion more US Treasury bonds, bills and notes, over the

next decade if the US is to fund the $1 trillion plus deficits every

year that now coming over the next decade, 2018-2028.

That’s $12 trillion on top of the

current $22.5 trillion national debt! That’s a $34 trillion national

debt by 2028! According to the Congressional Budget Office research,

that $34 trillion national debt will translate into no less than $900

billion a year just in interest payments on the debt by 2028—a roughly

tripling of interest payments that will have to come out of future US

budgets as well, in addition to escalating tax cuts and war-defense

spending.

How will the US government pay for

such escalating interest—as it continues to cut taxes for business,

investors and the wealthy while continuing to accelerate war and defense

spending?

20 Years of Accelerating National Deficits & Debt

The US government’s growing

Deficit-Debt problem did not begin with Trump, however. He just

represents the further acceleration of the Deficit-Debt crisis.

Trump’s escalating deficits and debt

are driven by two main causes: tax cutting and defense-war spending

increases. But this is just a continuation of the same under

Bush-Obama.

Studies show tax revenue shortfall

accounts for at least 60% of US deficits. Another 20% is due to

escalating defense spending, especially the ‘off budget’, so called

‘Overseas Contingency Operations’ (OCO) budget expenditures that go for

direct war spending. The OCO is in addition to the Pentagon’s official

budget, now to rise to $750 billion under Trump’s latest budget

proposal.

The US actual defense budget,

therefore, includes the $750 billion Pentagon bill, plus the OCO direct

war spending. Total defense-war spending also includes additional

‘defense’ spending for Homeland Security and for the CIA’s, NSA’s, and

US State Department’s growing covert military spending for their

‘private’ armies and use of special forces. It further includes spending

for Veterans benefits and military pensions, and for the costs of fuel

used by the military which is indicated in the US Energy Dept. budget

not the Pentagon’s. Add still more ‘defense’ spending on nuclear arms

billed to the Atomic Energy Agency’s budget. And let’s not forget the

$50-$75 billion a year in the US ‘black budget’ that fund’s future

secret military arms and technology, which never appears in print

anywhere in the official US budget document and which only a handful of

Congressional leaders in both the Republican and Democrat parties are

privy to know.

In short, the US ‘defense’ budget is well over $1 trillion a year and is rising by hundreds of billions a year more under Trump.

US wars in the Middle East alone since

2001 have cost the US at minimum $6 trillion, according to various

estimates. But contributing even more than wars to the now runaway

national deficits and debt is the chronic and accelerating tax cutting

that has been going on since 2001 under both Republican and Democrat

presidents and Congresses alike—roughly 80% of which has gone to

business, investors, and the wealthiest 1% households.

The Bush-Obama $14 Trillion Deficit-Debt Escalation

When George Bush took office in 2001

the national debt was $5.6 trillion. When he left it was approximately

$10 trillion. A doubling. When Obama left office in 2016 it had risen to

$19.6 trillion. Another doubling. (Under Trump’s first two years it has

risen another $3 trillion). For a US national debt of $22.5 trillion

today.

Under George W. Bush’s 8 years in

office, the tax cutting amounted to more than $4 trillion. Defense and

war spending accelerated by several trillions as well. The middle east

wars represent the first time in US history that the US cut taxes while

raising war spending. In all previous wars, taxation was raised to help

pay for war spending. Not anymore.

Obama cut another $300 billion in

taxes in 2009 as part of his initial 2009 economic recovery program. He

then extended the Bush tax cuts, scheduled to expire in 2010, for two

more years in 2011-12—at a cost of another $900 billion. He further

proposed, and Congress passed, an additional $806 billion in tax cuts

for business as the US economic recovery faltered in 2010. Obama then

struck a deal with Republicans in January 2013 to extend the Bush tax

cuts of 2001-08 for another entire decade—costing a further $2 trillion

during Obama’s second term in office (and $5 trillion over the next ten

years, 2013-2023). Thus $2 trillion of that further $5 trillion was

paid out on Obama’s watch from 2013-16 as part of the 2013 ‘Fiscal

Cliff’ deal he agreed to with the Republicans.

So both Bush and Obama cut taxes by

approximately $4 trillion each, for $8 trillion total. And defense-war

spending long term costs rose by $6 trillion under both.

Trump’s Deficit-Debt Contribution 2017-18

When added up, Bush-Obama 2001-2016

combined $6 trillion in war-defense spending hikes, plus their

accumulated $8 trillion in tax cutting, roughly accounts for the US

federal deficit-debt increase of $14 trillion, i.e. from $5.6 trillion

in national debt in 2000 to $19.5 trillion by the end of 2016.

To this Trump has since added another

$3 trillion during his first two years in office, which adds up to the

current $22.5 trillion US national debt.

Here’s how Trump has added the $3 trillion more in just two years:

In January 2018 the Trump tax cut

provided a $4.5 trillion windfall tax reduction over the next decade,

2018-2028, targeting businesses, multinational corporations, wealthy

households, and investors. US multinational corporations alone were

allocated nearly half of that $4.5 trillion.

So where did the 2018 Trump (and

continuing Bush-Obama tax cuts) go? Several bank research departments in

2018 estimate that in 2018 alone, the first year of Trump’s tax cuts,

that the S&P 500 largest corporate profits were boosted by no less

than 22% due to the tax cuts. Total S&P 500 profits rose 27% in

2018. So Trump’s tax cuts provided the biggest boost to their bottom

line.

Not surprising, with $1.3 trillion in

corporate stock buybacks and dividend payouts occurring in 2018 as well,

US stock markets continued to rise and shrug off corrections in

February and November that otherwise would have brought the stock market

boom to an end.

But starting this year, 2019, the

middle class will begin paying for those corporate-wealthy reductions.

Already tax refunds for the average household are down 17%, according to

reports. The middle class will pay $1.5 trillion in higher taxes by

2028, as the tax hike bite starts in earnest by 2022.

Another $1.5 trillion in absurd

assumptions by the Trump administration about US economic growth over

the next decade supposedly reduces the Trump’s $4.5 trillion of tax cuts

for the rich and their corporations by another $1.5 trillion. Thus we

get the official reported cost of only $1.5 trillion for the 2018 Trump

tax cuts. But the official, reported ‘only’ $1.5 trillion cost of

Trump’s 2018 tax cuts is the ‘spin and cover-up’. Corporate America,

investors and the wealthy 1% actually get $4.5 trillion, while the rest

of us pay $1.5 trillion starting, now in 2019, and Trump spins the

absurd economic growth estimations over the next decade.

The 2018 Trump tax cuts have reduced

US government revenues by about $500 billion in 2018. Add another $.5

trillion per year in Bush-Obama era tax cuts carrying over for 2017-18,

another $.4 trillion in Trump war and other spending hikes during his

first two years and more than $.6 trillion in interest payments on the

debt—and the total is a further $3 trillion added to the national debt

during Trump’s first two years.

So Bush-Obama add $14 trillion to the

$5.6 trillion debt in 2000. And Trump adds another $3 trillion so far.

There’s the $17 trillion addition to the $5.6 trillion national debt.[1]

And now, according to the Treasury

Advisory Committee, we can expect a further $12 trillion in debt to be

added to the national debt over the coming decade—to give us the $34

trillion and $900 billion a year just in interest charges on that debt!

Total US Debt: 2019

But it gets worse than another $12

trillion. Today’s $22.5 trillion, rising to $34 trillion, is just the US

national government debt. Total US debt includes state and local

government debt, household debt, corporate bond and business commercial

& industrial loan debt, central bank balance sheet debt, and

government agencies (GSEs) debt.

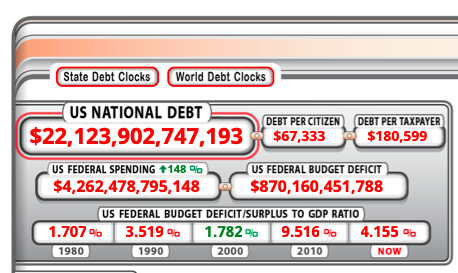

Screenshot from the US National Debt Clock: Real Time (as of March 14, 01:50 UTC)

Household debt is now $13.5 trillion

and rising rapidly for student loans, auto loans, credit cards and other

installment loans. In 2018, State and Local government debt was $3.16

trillion and rising as well. Corporate bond debt today is more than $9

trillion—two thirds of which is considered ‘junk’ and low quality BBB

investment grade bonds, much of which is likely to default in the next

recession. To this must be added other forms of business loan debt,

commercial paper, and the like. The Federal Reserve bank’s balance

sheet is also a form of debt, which is $4 trillion and, according to the

Fed recently, will not be reduced further. Other government housing

agencies, like Fannie Mae, add hundreds of billions more in US debt. All

these account for more than an additional $30 trillion in US debt.

Add these other forms of debt to the

national debt of $22.5 trillion and the total debt in the US rises

easily to around $53 trillion. And add the further $12 trillion

additional national debt on the horizon and further increases in other

forms of debt, and the total US debt may easily exceed $70 trillion by

2028. The $900 billion a year in interest charges assumed by the CBO may

thus be actually too low an estimate.

Who Pays the Debt and to Whom?

To whom do the various interest

payments on debt accrue? To the wealthy and their corporations who buy

the US and corporate bonds and who issue the credit cards, auto loans,

and mortgages; to their banks that offload their debt to the Federal

Reserve central bank during financial crises and recessions; to wealthy

investors who buy government and agency bonds; to wealthy shareholders

who have been getting $1 trillion a year since 2009 in dividends payouts

and capital gains from stock buybacks made possible in large part by

corporate bond raisings; and to wealthy households and corporations that

get the tax cuts that drive the deficit and debt.

Their ‘interest income’ is projected

to continue to accelerate over the next decade, thus further

exacerbating income inequality trends now plaguing the US and getting

worse.

Policies accelerating debt-based

income transfer since 2001 have been expanding and deepening since 2000,

across both Republican and Democrat regimes, from Bush through Obama,

now accelerating even faster under Trump.

For consumer and household debt,

clearly the working class-middle class pays most of the interest on the

debt—via mortgage, auto, student and credit cards, rising state and

local taxation, more federal taxation paying for the Trump tax cuts,

etc. The federal government—and thus the taxpayer–pay the interest on

the government bond debt. The creditors and owners of the debt reap the

benefits, now in the trillions of dollars annually.

The Trump budget proposes to pay for

the US government’s share of the total debt, by transferring the cost of

financing military-defense spending and tax cutting—which creates more

deficit and debt—to those households who aren’t investors and business

owners. But whether Trump gets his budget approved or not is irrelevant.

The deficits and debt will continue to accelerate nonetheless.

And if he does get to shift some of

the cost via extending his national emergency rule to the US spending in

general, not just his wall, the economic consequences will of course

even be worse.

*

Note to readers: please click the share

buttons below. Forward this article to your email lists. Crosspost on

your blog site, internet forums. etc.

This article was originally published on the author’s blog site: Jack Rasmus.

Jack Rasmus

is author of the forthcoming book, ‘The Scourge of Neoliberalism: US

Economic Policy from Reagan to Trump’, Clarity Press, forthcoming summer

2019, and ‘Central Bankers at the End of Their Ropes: Monetary Policy

and the Coming Depression’, Clarity Press, August 2017. He blogs at jackrasmus.com and hosts the weekly radio show, Alternative Visions, on the Progressive Radio Network. His website is http://kyklosproductions.com and tweets at @drjackrasmus. He is a frequent contributor to Global Research.

Note

[1]

Conservatives argue that this excludes rising social program spending

debt, like social security and medicare. But those programs are not

financed out of the US budget (with the exception of the prescription

drugs program for seniors). They have their own tax base, the payroll

tax. What about the 2008-09 bailout? The banks were bailed out by the

Federal Reserve not Congress. And the costs of social program spending

hikes after 2008-2011, were offset by a $1.5 trillion cut in social

spending that started in August 2011—which exempted effectively cuts in

defense spending thereafter.

The original source of this article is Global Research

Copyright © Dr. Jack Rasmus, Global Research, 2019