Banyan Hill Publishing’s Matt Badiali called it “an oil market for the ages” as oil prices reached their lowest in history.

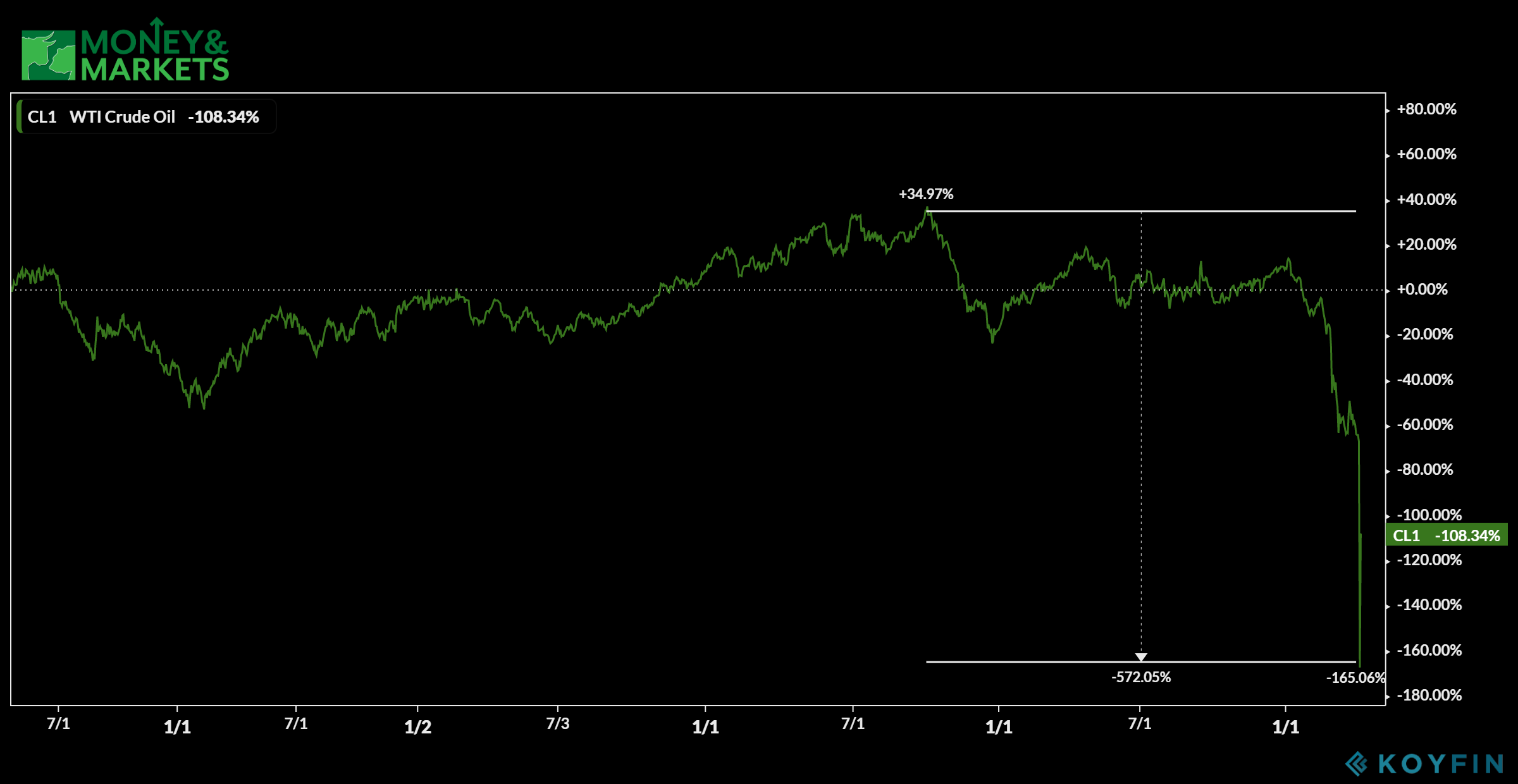

Since October 2018, West Texas Intermediate crude has shed 572% off its contract price — with most of that drop coming in the last few weeks.

Those bottoming prices have pushed equities back into negative territory after a weeks-long rally.

However, Badiali said he sees the pendulum swinging back higher and the main reason behind that is shale.

Shale is a fine-grained sedimentary rock containing organic matter that yields large amounts of oil and combustible gas when it’s distilled, according to geology.com. Commercial grades of oil shale yield between 100 to 200 liters per metric ton of rock.

Why the Oil Market Tanked So Badly

Despite a cut of around 10 million barrels of oil per day in production from oil-rich countries like Saudi Arabia and Russia, the coronavirus outbreak has taken a toll on demand.That demand dropped by around 30 million barrels per day. So, even the cut in production did not match the drop in demand.

The other problem is storage.

Badiali, a former geologist and editor of Real Wealth Strategist, which is your go-to source for investing in natural resources, said there is no place to put the oil that’s coming in from fields in the U.S. and imported from other countries.

“The real sticker is where to put the excess crude. We are almost out of room. Storage at Cushing, Oklahoma — the main hub — is at 55 million barrels,” Badiali said. “It can only hold 75 million or so. And 45% of what’s in storage there arrived since February. That’s why the futures are getting crushed.”

Oil Isn’t Going Anywhere

Regardless of supply and demand issues, there is currently no substitute for oil. Aircraft, cars, trucks and many other end products use the resource.“Maybe the elite few can afford electric, but not in 99% of the world,” Badiali said.

And producers will have a difficult time just shutting down their oil wells.

“The trouble with oil wells is that you can’t just shut them off,” Badiali said. “If you do, you damage the reservoir. Often, it doesn’t recover or you get a fraction of the production you had.”

Why Shale is the Answer to the Oil Market Problem

Badiali said between 2008 and 2019, the U.S. increased its oil production by 7 million barrels per day.That increase was mostly from shale. With the world using around 100 million barrels of oil per day, U.S. shale represents around 7% of that consumption.

With the recent fall in oil market futures, already struggling shale producers are likely to hit rock bottom, stifling production.

“They haven’t been cash-flow positive in the last seven years. None of them,” Badiali said. “And they owe over $37 billion in long term debt. Somebody is going to get hung out to dry when they go bankrupt.”

As those shale oil wells shut off, production will cut back significantly. That means oil prices will jump and excess supply gets used up in 12 to 18 months.

“Without shale, the world is running at a huge supply deficit,” Badiali said. “So I don’t think oil prices will stay low because the oil industry will look a whole lot different in 18 to 24 months.”