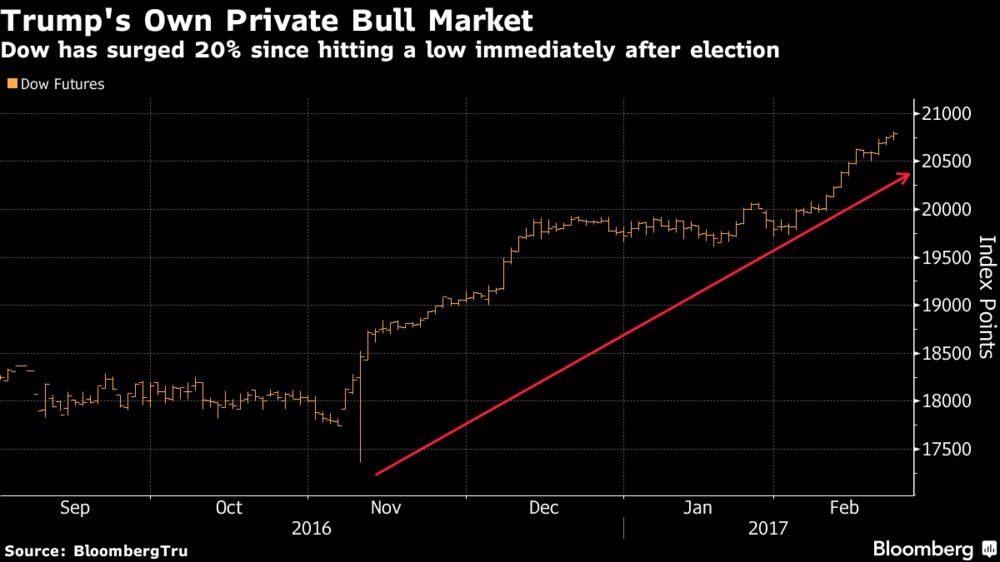

The Trump bump keeps getting huger.

Consecutive gains in the

Dow Jones Industrial Average have left it at the doorstep of history,

including a 20 percent surge in futures from the early hours of Nov. 9

that could be loosely framed as the president’s own bull market. The

120-year-old measure has set a record on 10 straight days -- the longest

streak since the Ronald Reagan administration. Two more would tie it

for the longest ever.

How

does the future look when stock prices jump this fast? There’s good and

bad news. The last time it happened, in January 1987, the Dow dropped

11 percent over the next year as the market endured one of its worst

crashes. The previous occurrence in March 1964 saw the index climb 9.3

percent over 12 months.

The Dow’s continuing streak of all-time highs is the longest

since it closed at a record 12 straight times in 1987. If the run got to

13, that would be the longest ever, according to Bloomberg data dating

back to 1952. Records aside, the Dow’s streak of daily gains is also the

longest in almost four years and would tie for the longest in 25 years

with a jump Friday.

To be sure, the contour of the rally has evolved since

its first weeks, and not in an altogether good way. Energy stocks, one

of the leading groups of the post-election surge, have faltered, down

2.5 percent this month. Small-cap shares thought to benefit most from

Trump’s domestic growth agenda have also slowed, adding just 2.4 percent

in February after surging 16 percent in the month following the vote.Investors

are putting more money into equities. Traders have poured $45 billion

into American stock ETFs and mutual funds in four months after yanking

money in seven of the past nine years, data compiled by Investment

Company Institute and Bloomberg show.